We will be pleased to share our experience and provide answers and solutions to some of these questions:

- Why business owners and investors want to sell businesses?

- What is investors motivation to buy the business?

- What will the investors be looking at in a business?

- Is your business ready “to be sold” and fit for purpose?

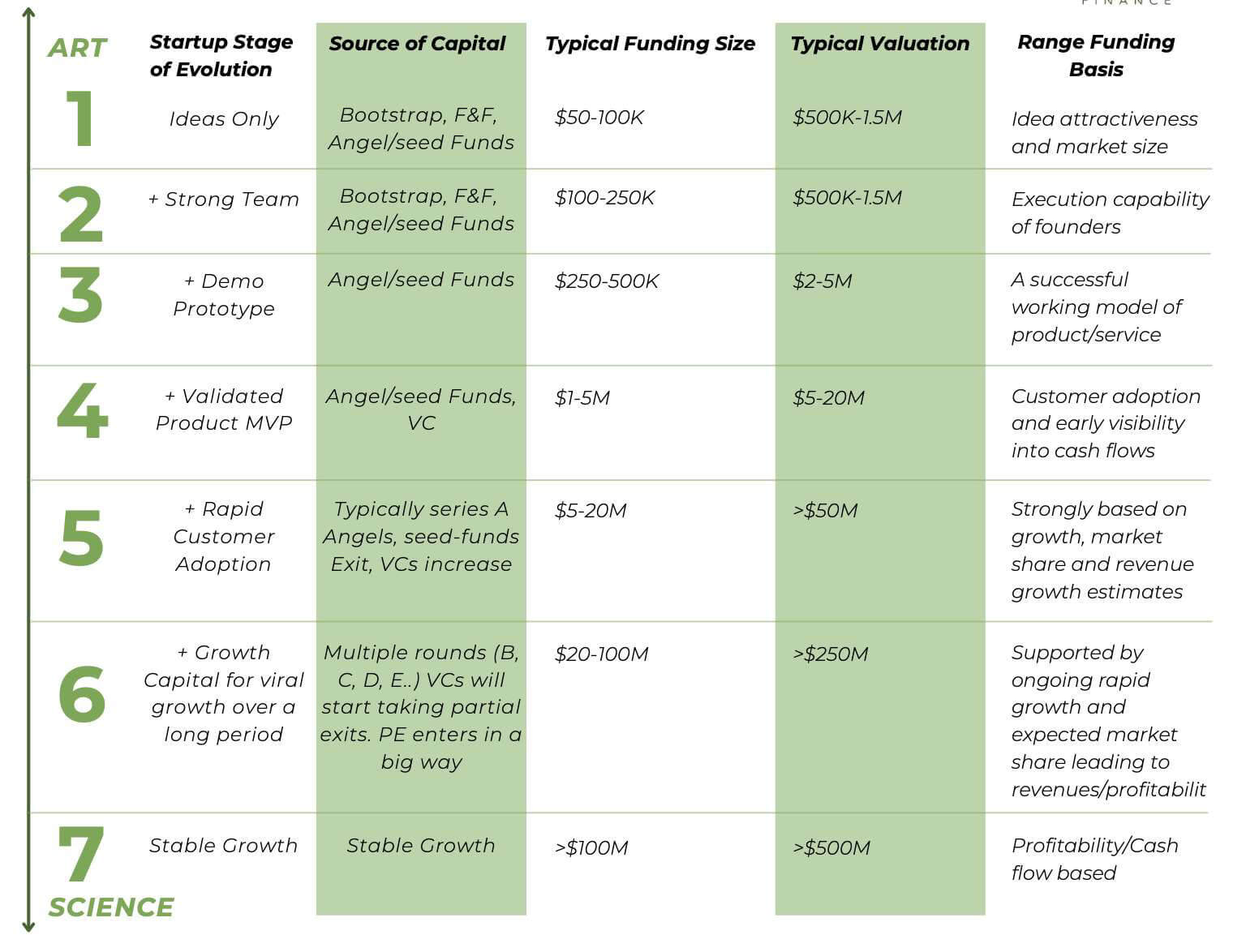

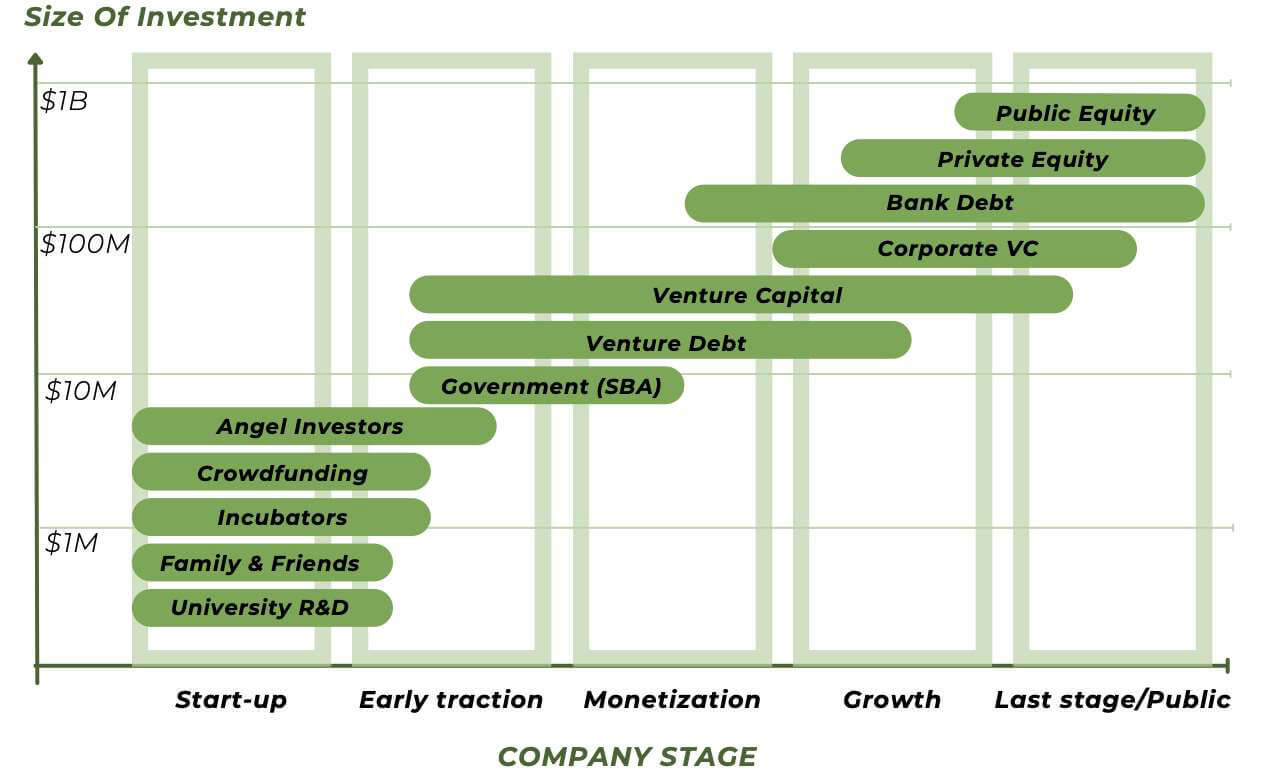

- What Valuation methodology to use and why?

- What would be required for investor due diligence?

- How to create meaningful information memorandums?

- How well polished is the founder’s story?

- How to maximize EBIDTA?

- How to present shareholder value and synergies to the businesses?